July survey of rural bankers shows fourth straight month of recession-level readings, drop in customer visits

|

| Creighton University chart compares current month to month and year ago; click here to download it and chart below. |

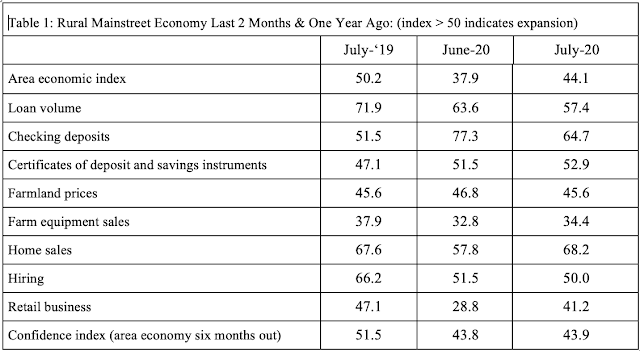

The economy in the rural Midwest improved slightly but remained weak and below pre-pandemic levels in the past month, according to the newest update of Creighton University‘s Rural Mainstreet Index. The index is a survey of bankers in about 200 rural communities with an average population of 1,300 in 10 states where agriculture and energy are critical to the economy: Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota and Wyoming.

July’s report was the fourth straight month that had readings consistent with a recession. “The overall index for July climbed to 44.1, well below growth neutral, but up from June’s 37.9 and April’s record low 12.1,” reports Creighton economist Ernie Goss, who does the index. “Farm commodity prices are down by 12.5 percent over the last 12 months. As a result, and despite the initiation of $16 billion in USDA farm support payments, only 6% of bankers reported their area economy had improved compared to June while 17.6 percent said economic conditions had worsened.”

Farmland prices continue to drop, and though farm equipment sales increased marginally to 34.4 from 32.8 in June, it’s the 82nd straight month the category has been below growth neutral reading of 50.0, Goss reports.

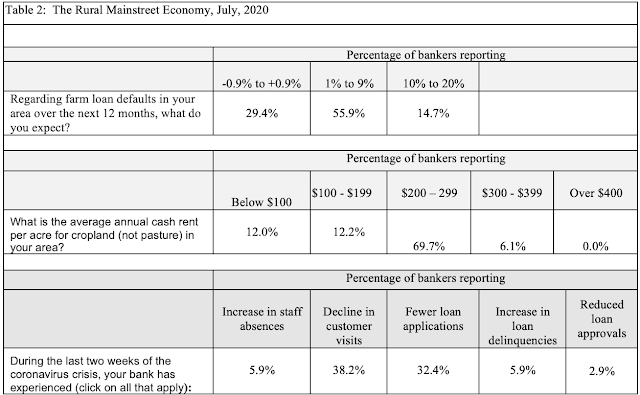

Of the bankers surveyed, 55.9% said they expect 1-9% of farm loans in their area to default over the next 12 months. And during the last two weeks of the pandemic, 38.2% said they’d seen a decline in customer visits and 32.4% said they’d seen fewer loan applications.

|

| Creighton University chart |

![Foothills-Bundle] Foothills-Bundle](https://thelevisalazer.com/wp-content/uploads/2020/05/Foothills-Bundle-422x74.jpg)